Dubai has become one of the most attractive real estate investment destinations in the world. With strong rental demand, tax-free income, and a steady flow of international investors, the city continues to outperform many global property markets. Whether you are a first-time buyer or an experienced investor, one question almost always comes up:

Should you invest in off-plan apartments or buy a ready apartment in Dubai?

Both options offer clear advantages, but the right choice depends on your investment goals, budget, and risk appetite. This guide explains the differences between off-plan and ready apartments in simple terms, helping you decide which option suits you best.

Understanding Off-Plan Apartments in Dubai

Off-plan apartments are properties purchased before construction is completed. In some cases, buyers invest even before the building work begins. Developers sell these units early to raise project funds, which allows investors to enter the market at lower prices.

One of the main reasons investors prefer off-plan apartments in Dubai is the flexible payment structure. Buyers usually pay a small booking amount and then continue with instalments during the construction period. This makes off-plan apartments particularly attractive to foreign investors who want to manage cash flow efficiently.

Another advantage is capital appreciation. As the project progresses and the surrounding community develops, property values often increase. By the time the apartment is handed over, the market price can be significantly higher than the original purchase price.

What Are Ready Apartments in Dubai?

Ready apartments are completed properties that are immediately available for occupancy or rental. These apartments can be purchased directly from developers or through the secondary market.

The biggest advantage of ready apartments for sale in Dubai is instant rental income. Investors do not have to wait for construction to finish. Once the purchase is complete, the property can be rented out right away, generating monthly cash flow.

Ready apartments also involve less uncertainty. The building, amenities, and community are already developed, making it easier to evaluate rental demand and long-term value. This option is often preferred by investors who prioritise stability and predictable returns.

Off-Plan vs Ready Apartments Dubai: A Clear Comparison

When comparing off-plan vs ready apartments in Dubai, the differences become clearer once you look at the investment fundamentals.

Off-plan apartments usually come with lower entry prices and higher long-term growth potential. However, rental income only starts after project completion. Ready apartments cost more initially but offer immediate rental returns with lower risk.

Off-plan properties suit investors who are comfortable waiting for returns and aim to benefit from price appreciation. Ready apartments are ideal for buyers who want income from day one and prefer a more conservative investment approach.

Rental Returns: Off-Plan vs Ready Investment Performance

Rental yield is one of the most important factors for property investors in Dubai. Both off-plan and ready apartments can deliver attractive returns, but the timing and structure of those returns differ.

Historically, ready apartments tend to generate stable rental yields in the range of six to seven percent annually. These returns begin immediately, making them appealing for investors seeking regular income.

Off-plan apartments, on the other hand, often produce higher overall returns over time. Although rental income starts later, the lower purchase price and appreciation during construction can significantly improve long-term profitability.

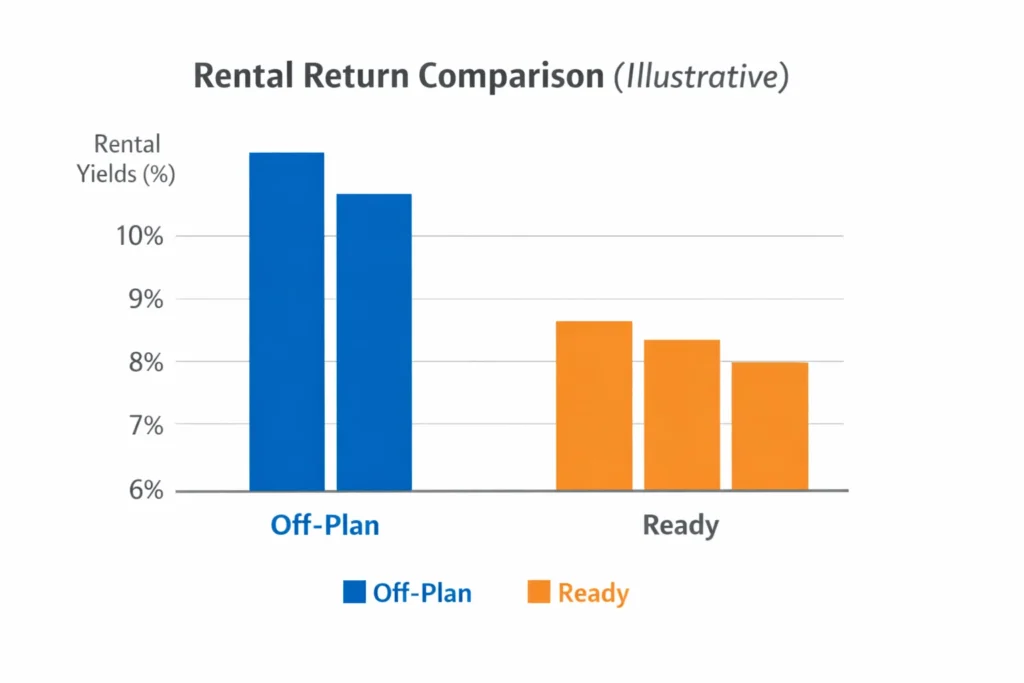

Below is a simple illustrative comparison showing how off-plan investments often outperform ready apartments in total returns over time.

Rental Return Comparison (Illustrative)

Off-plan investments generally deliver stronger long-term returns due to appreciation and competitive rental pricing after handover, while ready apartments provide consistent but slightly lower yields.

How Off-Plan and Ready Investments Work in Real Life

An off-plan investment usually begins with selecting a project from a reputable developer. After paying a booking amount, the buyer continues with scheduled payments during construction. Once the apartment is completed, the investor can either rent it out or sell it at market value.

Ready apartment investments follow a more straightforward process. After purchase, the apartment can be listed for rent immediately. This makes ready apartments especially attractive for investors who want quick returns without waiting.

Which Option Is Better for Your Investment Goals?

Choosing between off-plan and ready apartments in Dubai depends largely on what you want from your investment.

If your goal is long-term wealth creation, off-plan apartments can be a strong option. Buying at an early stage allows you to benefit from price appreciation and rising rental demand once the project is completed. This strategy works well for investors with a longer holding period.

If your focus is immediate rental income, ready apartments are often the better choice. They provide a predictable cash flow and require less patience. Many investors rely on rental apartments to cover mortgage payments or generate monthly income.

Off-Plan Apartments Dubai for Foreign Investors

Dubai is one of the most foreign-investor-friendly property markets in the world. Non-residents are allowed to purchase both off-plan and ready apartments in designated freehold areas.

Off-plan apartments in Dubai for foreigners are particularly popular due to flexible payment plans and lower entry costs. Many international investors also consider property ownership as a pathway toward long-term residency options, depending on investment value.

Real Investment Examples

Consider an investor who buys a 1 bedroom apartment for sale in Dubai through an off-plan project. The purchase price is lower than similar ready units, and by the time the property is completed, its value has increased significantly. Once rented, the apartment generates high annual income along with capital appreciation.

In another case, an investor purchases a ready studio apartment for sale in Dubai. Rental income begins immediately, providing a stable cash flow. While price appreciation may be slower, the investor benefits from consistent returns without waiting.

Both strategies are profitable, but each suits a different investment mindset.

Risks You Should Consider Before Investing

Off-plan investments may involve construction delays or market fluctuations. Choosing reputable developers and established locations reduces these risks significantly.

Ready apartments carry lower risk, but higher upfront costs and maintenance expenses should be factored into the investment decision. Reviewing service charges and rental demand is essential before buying.

Practical Tips to Maximise Returns

Location plays a major role in rental performance. Areas with strong infrastructure, public transport, and lifestyle amenities usually perform better.

Understanding rental cycles in Dubai can also help investors time their leasing strategy effectively. Professional property management is highly recommended, especially for overseas investors.

Final Thoughts: Off-Plan vs Ready Apartments in Dubai

There is no single answer that suits every investor. Off-plan apartments offer higher long-term growth potential, while ready apartments provide immediate and stable rental income.

Many experienced investors choose to balance both options within their portfolio. By aligning your property choice with your financial goals, Dubai’s real estate market can offer strong and sustainable investment returns.

FAQs

Q1: Is off-plan property safe in Dubai?

Ans: Yes, Dubai has strict regulations that protect buyers, especially when purchasing from established developers.

Q2: Can foreigners buy ready apartments in Dubai?

Ans: Yes, foreigners can buy both ready and off-plan apartments in approved freehold areas.

Q3: Which option offers better rental income?

Ans: Ready apartments provide immediate rental income, while off-plan apartments often deliver higher overall returns over time.

Q4: Are off-plan apartments cheaper than ready apartments?

Ans: In most cases, off-plan properties are priced lower than ready units in the same area.